April 25, 2024

Tata Motors Accelerates Innovation: Record 222 Patents Filed and 333 Grants Secured in FY24

Read more

Access our latest announcements, results, share price information and other resources here

Tata Motors Ltd announced its results for quarter ending March 31, 2022. The results represent the details on consolidated segment level. Please refer “Reporting format” section in the end for details.

| Consolidated (₹ Cr Ind AS) |

Jaguar Land Rover (£m, IFRS) |

Tata Commercial Vehicles (₹Cr, Ind AS) |

Tata Passenger Vehicles (₹Cr, Ind AS) |

||||||

|---|---|---|---|---|---|---|---|---|---|

| FY’22 | Vs. PY | FY’22 | Vs. PY | FY’22 | Vs. PY | FY’22 | Vs. PY | ||

| Q4 FY22 |

Revenue | 78,439 | (11.5) % | 4,767 | (27.1) % | 18,529 | 29.3 % | 10,491 | 62.0 % |

| EBITDA (%) | 11.2 | (320) bps | 12.6 | (270) bps | 5.9 | (290) bps | 6.9 | 190 bps | |

| EBIT (%) | 3.2 | (410) bps | 2.0 | (550) bps | 3.4 | (220) bps | 1.2 | 400 bps | |

| PBT (bei) | 373 | – | 9 | – | 607 | – | 42 | – | |

| FY22 | Revenue | 278,454 | 11.5 % | 18,320 | (7.2) % | 52,288 | 57.9 % | 31,515 | 89.8 % |

| EBITDA (%) | 9.6 | (260) bps | 10.3 | (250) bps | 3.7 | (50) bps | 5.3 | 330 bps | |

| EBIT (%) | 0.7 | (190) bps | (0.4) | (300) bps | 0.4 | 130 bps | (2.0) | 750 bps | |

| PBT (bei) | (6,374) | – | (412) | – | (133) | – | (857) | – | |

Jaguar Land Rover (JLR): Revenue was £4.8 billion in Q4 FY22, up 1% from Q3 FY22, reflecting the higher wholesales offset partially by the impact of the runout of the previous generation Range Rover, with the New Range Rover still ramping up. The EBIT margin in the quarter was 2.0% with profit before tax about breakeven (£ 9 million) before £ (43) million exceptional charge for our business in Russia. Free Cashflow improved to £340 million, up from £164 million in Q3.

Tata Commercial Vehicles (Tata CV): Tata CV business continued to show strong sequential recovery led by MHCV segment. The business clocked its highest quarterly revenues since Q4’FY19 and grew market shares in all segments. Despite lower margins due to commodity inflation, impact was lower on PBT (bei) of ₹ 607 Crores in Q4 due to operating leverage from higher revenues.

Tata Passenger Vehicles (Tata PV): Tata PV business delivered a comprehensive turnaround in Q4 FY 22 with highest quarterly revenues of ₹10.5 K Cr (+62%), positive EBIT 1.2% and positive free cash flows. EV volumes rose to 9.1K units in Q4 and PV market share improved to 13.4% (+440bps). Robust demand for “New Forever” range and agile supply actions led to this strong performance.

Outlook: The demand remains strong despite geopolitical and inflation concerns. The supply situation is gradually improving, whereas commodity inflation is likely to remain at elevated levels. We expect performance to improve through the year as the China COVID and semiconductor supplies improve and aim to deliver strong EBIT improvement and free cash flows in FY 23 to get to near net auto debt free by FY 2024.

JAGUAR LAND ROVER (JLR)

Highlights

Financials

Wholesales (excluding the China Joint Venture) in Q4 were 76,526 units, up 11% on Q3 FY22 with higher production volumes. Retail sales in Q4 were 79,008 vehicles, down 1% from Q3 FY22 as a consequence of constrained wholesales and low dealer inventories, while the mix of electrified retail sales (BEV, PHEV and MHEV) increased to 66% for the full year compared to 51% in the prior year. Wholesales for the full year FY22 were 294,182, down 15% compared to FY21. Retail sales for FY22 were 376,381, down 14% compared to FY21.

Full year performance in FY22 was significantly impacted by the constraint on production and sales resulting from the global chip shortage. Revenue was £18.3 billion, down 7% from the prior year, with a pre-tax loss of £412 million before the £ (43)m Q4 exceptional charge, compared to a PBT of £662 million before exceptional items in FY21. The impact on working capital of the reduced volumes in the first half of the financial year resulted in a free cash outflow of £1.16 billion for FY22. The working capital outflow is expected to be recovered over time as volumes gradually increase. While sales to Russia remain paused, Russia and Ukraine historically account for about 2.5% combined of global sales. The impact on production has been limited to date as a result of active management of our parts supply chain. While we have a relatively small number of parts that are sourced from the affected countries, it is too early to say how future commodity supply and pricing could be impacted.

Looking Ahead

Inflation represents an increasing headwind for the business and we expect our Refocus actions to help mitigate this in the coming year. We expect the global semiconductor shortage to continue through the next fiscal year with gradual improvement. However, the Covid lockdowns in China as well as the new Range Rover Sport model changeover are expected to limit volume improvements in Q1 possibly resulting in negative EBIT and negative free cash flows in the quarter. Volumes are expected to improve progressively thereafter, and we target achieving a 5% EBIT margin and £1bn+ positive free cash flow in FY23 for the full year. Our medium- and longer-term financial targets under the Reimagine strategy, underpinned by the Refocus transformation programme, remain unchanged, including improving EBIT margins to 10% or more by FY26 and improving cash flow to achieve near zero net debt in FY24.

Thierry Bolloré, Jaguar Land Rover’s Chief Executive Officer, said: “The environment remains difficult in light of the global chip shortage and other challenges. However, I’m encouraged by the continuing strong customer demand for our products, highlighted by a record order book. And we are continuing to execute our Reimagine Strategy with exciting new products like the Defender, New Range Rover and just announced New Range Rover Sport while we are rapidly progressing our plans for a new generation of electric vehicles with our all electric Jaguar strategy and BEV first EMA platform for new Land Rover products.”

TATA COMMERCIAL VEHICLES (TATA CV)

Highlights

Financials

The CV industry witnessed a strong rebound in FY 22, after two consecutive years of decline. The domestic business gained market share across all segments in FY22. The strong volumes and market share growth, with repeat customer orders, is testimony to the strong BS-VI product portfolio.Q4 revenues stood at ₹ 18.5K Cr (+29% Y-o-Y and +34% Q-o-Q). While in Q4 EBITDA margins were at 5.9% (lower 290 bps Y-o-Y), Q-o-Q there was a 330 bps recovery due to impact of price hikes, improved mix and stable commodity prices in Q4. For FY 22, business recorded revenues of ₹ 52.3K Crs (+ 58%), EBITDA margin of 3.7% (-50 bps), EBIT margin of 0.4% (+130 bps) and PBT (bei) of (0.1)K Crs. Operating leverage from higher revenues delivered better PBT (bei) despite lower EBITDA margins.

Looking Ahead

The CV industry is poisedfor further growthon the back of increased activity in road construction, mining and improved infrastructure spending. The supply situation continues to show gradual improvement. Despite uncertainties, business sentiments continue to be positive with increasing fleet utilization levels and freight rates. Sharp commodity inflation, however, continues to remain a challenge. The Company will continue to step-up its investments in products and new business models to deliver customer value while ensuring profitable growth. Despite near-term supply challenges and inflation concerns, the business aims to deliver strong margins recovery and profitability in FY23.

Girish Wagh, Executive Director Tata Motors Ltd said: “The Indian Commercial Vehicles sector, deeply impacted for two successive years, showed promising signs of growth in FY22 supported by a steady recovery in the economy, rising industrial activity and reopening of markets. At Tata Motors, the early adoption of a holistic ‘Business Agility Plan’ enabled us to protect and serve the interests of our customers, dealers and suppliers as well as smartly manage supply related challenges including the global shortage of critical electronic parts. The improvement in consumer sentiment, buoyancy in e-business, firming freight rates, reopening of schools and offices and higher infrastructure spends in road construction and mining helped regenerate demand. We optimized production, introduced new passenger and cargo mobility solutions and accelerated sales to grow every quarter and gain higher market share in every segment of commercial vehicles. Looking ahead, we see significant opportunities to leverage the mega trends shaping the Indian automotive industry. We are keeping a close watch on geopolitical developments, fuel inflation and semiconductor shortage and remain optimistic whilst continuing to work closely with our customers and ecosystem partners to mitigate risks and manage uncertainties.”

TATA PASSENGER VEHICLES (TATA PV)

Highlights

Financials

Tata PV business delivered a consistent and strong performance leading to the highest quarterly and annual sales in TML history. The business witnessed strong revenues of ₹ 31.5 K Cr in FY 22 (+ 90% Y-o-Y as compared to ₹ 16.6 K Cr in FY 21). Robust demand for New Forever range and agile actions taken on the supply side drove volumes growth. EV sales continued to witness a rapid growth in demand on the back of strong acceptance of Nexon EV and Tigor EV. Profitability improved significantly with positive EBIT achieved in Q4 FY 22 and strong 750 bps EBIT improvement for FY 22. Market shares continue to improve to 12.1% in FY22.

Looking Ahead

In Passenger Vehicles, the company will continue to drive strong sales performance whilst improving profitability and managing supply bottlenecks. In Electric Vehicles, the business will drive up penetration and accelerate sales further. The business is expected to deliver strong improvement in margins and profitability in FY23. The business will continue to step-up new product launches and enhance capacities to cater to increasing demand. Despite significant step-up in investments, the PV business is expected to remain self-sustaining whilst the EV business investments are well funded with the capital infusion.

Shailesh Chandra, Managing Director Tata Motors Passenger Vehicles Ltd & Tata Passenger Electric Mobility Limited said: “In a challenging year disrupted by Covid, semi-conductor crisis and steep increase in commodity prices, Tata Motors set several new records in passenger and electric vehicles to make FY22 a landmark year. We posted our highest ever annual, quarterly and monthly sales in March 22 and introduced new nameplates and aspirational variants to substantially improve our market share overall as well as in every segment of cars and SUVs where we have a presence. We also operationalized two subsidiaries- Tata Motors Passenger Vehicles Ltd. focusing on passenger vehicles powered by IC engines and Tata Passenger Electric Mobility Limited to accelerate the development of the passenger EV business and its enabling ecosystem with TPG Rise Climate as an investor. Going forward, the demand for our ‘New Forever’ range continues to remain strong even as the semi-conductor situation and supply side challenges remains uncertain. We remain agile and will continue to take prudent actions while enhancing our focus on future-fit initiatives of transforming customer experience digitally and strengthening our established lead in sustainable mobility.”

ADDITIONAL COMMENTARY ON FINANCIAL STATEMENTS

(Consolidated Numbers, IND AS)

Finance Costs

Finance costs increased by ₹ 1, 215Cr to ₹ 9,312Cr during FY’22 due to higher gross borrowings.

Joint ventures, Associates and Other income

For the year, net loss from joint ventures and associates amounted to ₹74Cr compared with a loss of ₹ 379Cr in FY21. Other income (excluding grants) was ₹ 929Cr in the current year versus ₹ 725Cr in the prior year.

Free Cash Flows

Free cash flow (automotive) in the year, was negative at ₹9.5 KCr (as compared to positive ₹ 5.3K Cr in FY 21), primarily due to working capital impact of ₹9.6 KCr. The business showed strong sequential recovery with positive free cash flow (automotive) of ₹ 11.9K Cr in H2.

REPORTING FORMAT

The press release represents results provided the details on consolidated segment level. The operating segment comprise of automotive segment and others.

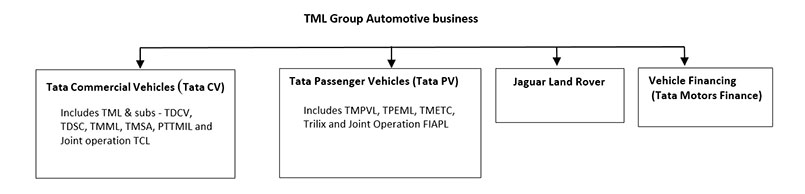

In automotive segment, results have been presented for entities basis four reportable sub-segments as below

© Copyright 2024. All rights reserved. Tata Motors Limited.